FIFO Inventory Method

It is a very common method used in accounting for inventory costs. It assumes that the oldest inventory items are sold or consumed first. For perishable goods companies, this method is very effective since it ensures older merchandise moves out before the new ones. Retail, manufacturing, and food establishments use it in their everyday trade activities since it follows the natural flow of goods.

How FIFO Works?

By means of FIFO, inventory moves first from its ageing stage to the sale or production stage. Considering this method allows businesses to retain inventory freshness in the market, avert obsolescence, and attain a more accurate reflection of the cost of goods sold during times of stable or rising prices.

What is the difference between FIFO and LIFO?

Going with FIFO means selling the oldest inventory first; LIFO goes by selling the newest inventory first. Thus, FIFO can lessen the cost of goods sold and thereby increase profits in times of inflation, whereas LIFO can be used as a tool to lower the taxes. In fact, international accounting standards do not permit LIFO.

What Types of Businesses Commonly use FIFO?

FIFO is commonly used by industries that handle perishable or time-sensitive goods, such as grocery, pharmaceutical, e-commerce, and consumer electronics retailers. It benefits these businesses by simplifying inventory rotation and minimising wastage.

How to Calculate FIFO?

To calculate FIFO, the cost of the oldest inventory is applied to the first units sold. Businesses identify the costs of the initial inventory purchased and subtract those costs from revenue when items are sold, thereby determining the COGS. This method ensures that older stock is cleared out first, keeping inventory fresher and better aligned with actual product flow. It is especially effective in businesses where inventory is time-sensitive, such as perishable goods or products with expiration dates.

Why is the FIFO method popular?

It is popular because it is easy to understand and apply, provides transparency in financial reporting, and most importantly, it follows the general flow of goods in various industries. It ensures accurate valuation of inventories and also stands as a globally accepted mode of accounting, including free accounting practices in India. When prices are rising, it presents a lower Cost of Goods Sold (COGS) and increases taxable income, the latter of which casts a favourable look on the Vice President for presentation before investors or lenders.

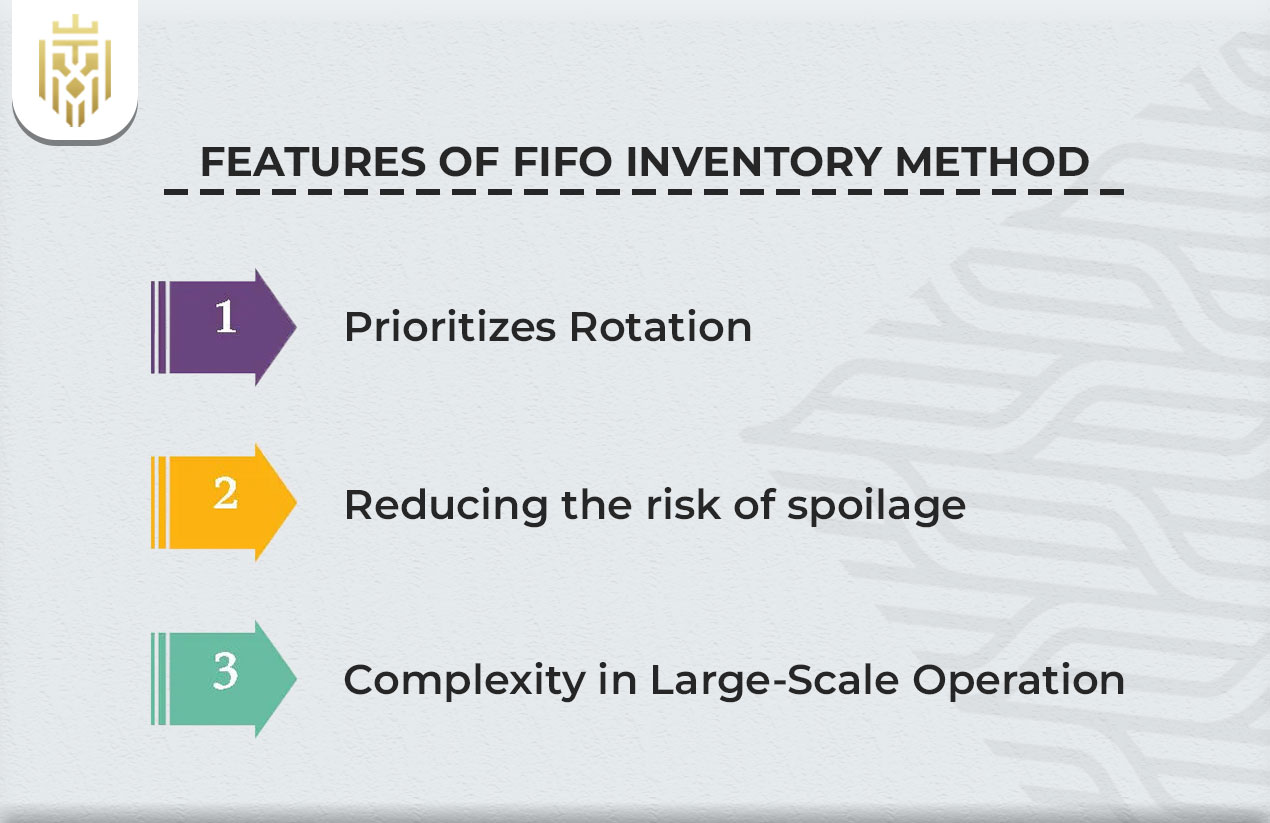

Features of FIFO Inventory Method

FIFO (First-In, First-Out) offers several key features that make it a preferred choice in inventory management, especially where product freshness and financial accuracy are crucial.

Prioritises Rotation

This method encourages the natural stock flow wherein older inventory is worked through before new stock enters the circulation. It acts toward efficiency at operations, thereby minimising interruptions from frequent manual inventory checks, shuffles, and so on.

Reducing the risk of spoilage

The main purpose of FIFO is to sell older goods that might run out of shelf life or get obsolete. This is indeed the case with industries with perishable goods like the food, pharmaceutical, or cosmetic industry.

Complexity in Large-Scale Operations

In a big environment, it can be illusive to track an inventory in the order it was taken without systems to do so, supposedly. It is, therefore, necessary to have good records and automation tools so as to keep out any discrepancies that might creep in.

Benefits of using FIFO

The FIFO inventory method offers strategic advantages that improve financial performance, operational efficiency, and customer satisfaction across industries.

Improved Inventory Turnover

With FIFO, companies are stimulated to keep inventory flowing steadily to receipt of cash and reduction of warehouse storage charges. This further allows better shelf placements and faster reaction to contravening market pressures.

Higher Reported Profits

Older stock has a lower cost so that it can lower the cost of goods sold and show larger profits in the books. This increase in the reported income will aid in the attraction of investors and improve the valuation of the business.

Enhanced Customer Satisfaction

Older inventories should be given priority in release and distribution to ensure products are fresher and more reliable. Trust is instilled, thereby encouraging customers’ return for repeat purchases.

Reduced Waste and Obsolescence

The products are kept from becoming unserviceable and wasted by the FIFO, thus preventing losses and harming the environment. It also promotes green-friendly inventory practices by minimising unwarranted disposal.

Challenges of FIFO Inventory Method

While FIFO is beneficial, it also presents operational and financial challenges that must be managed to maintain accuracy and efficiency.

Higher Taxes in Times of Inflation

FIFO will inflate taxable incomes since, whereas under it the older, less expensive inventory is plumbed into the cost of goods sold, there arise higher reported incomes. These could indeed result in reduced net incomes after taxes if inflation in fact persists.

Requires Accurate Tracking Systems

To do FIFO correctly, a business must keep track of precise inventory records and batch numbers. Without higher systems, we shall have an increased risk of inventory mismanagement and reporting errors.

Inaccurate Representation of True Costs

Sometimes with historical costs being applied, FIFO may not reflect the actual market value of the inventory if prices are changing at a very rapid pace. This, in turn, could affect pricing decisions and margin analysis.

FAQs

1) What is the FIFO Inventory Method?

The FIFO method is used in managing inventory wherein the oldest inventory items are sold or utilised first.

2) How to Calculate FIFO?

FIFO calculations apply the costs of the oldest inventory stock to the cost of goods sold for a particular sales period.

3) What is the difference between FIFO and LIFO?

FIFO sells the oldest stock first, while LIFO sells the newest. FIFO results in higher profits and is globally accepted; LIFO is mainly used in the U.S.

4) How FIFO Works?

FIFO operates on the principle of moving older inventory first through the sales cycle, keeping stock fresh and financials transparent.