What is Trade Finance?

Trade finance refers to the funding, instruments, and methods that help facilitate international trade by connecting buyers and sellers. Understanding what is trade finance is important for businesses entering global markets. It includes financial tools and solutions that reduce risks, ensure payment security, and support cross-border transactions, making it essential for international trade operations.

Trade Finance Role in Global Logistics

Trade finance plays an important role in global logistics by aligning financial flows with the movement of physical goods. It supports timely payments, ensures liquidity, and limits trade risks. Logistics companies benefit from improved working capital management, allowing for smooth trade across complex multinational supply chains.

Bridging Payment Gaps

International trade finance is key to bridging payment gaps across borders with differing timelines. Exporters want immediate payment, while importers prefer deferred settlements. By meeting both needs, trade financing builds trust, reduces conflicts, and maintains healthy relationships in international markets and supply chains.

Syncing Goods and Cash Movement

Coordinating the movement of goods and payments can be challenging in global logistics. Trade finance activities ensure synchronisation, helping exporters and importers avoid liquidity shortages. This financial coordination strengthens reliability, prevents supply disruptions, and keeps global cargo movements in line with agreed terms.

Key Trade Finance Instruments

Multiple instruments support trade finance activities in logistics, including Letters of Credit, guarantees, and insurance. These tools reduce risks, improve liquidity, and foster trust between exporters and importers, ensuring efficient trade operations within global logistics networks.

Letters of Credit

Letters of Credit are crucial in trade finance and lending, providing payment assurance to exporters once shipment terms are fulfilled. They decrease credit risks, boost confidence among partners, and ensure international transactions proceed smoothly without delays, strengthening trust in global commerce.

Supply Chain Finance

Trade finance and supply chain finance work together to offer logistics businesses liquidity options. By providing flexible cash flow solutions, supply chain finance helps importers manage working capital while allowing exporters to receive payments early, creating balance and efficiency in global trade systems.

Invoice Financing and Discounting

Invoice financing helps secure early liquidity by enabling exporters to receive payments before due dates. Through a trade finance account, companies access working capital tied to receivables, maintaining operational flow and easing pressure during lengthy international trade cycles, ensuring smooth logistics operations.

Export Credit Insurance

Export Credit Insurance acts as a protective shield in international trade finance. It protects exporters against defaults or political risks, ensuring they get paid even if buyers fail. This risk mitigation builds resilience for logistics providers navigating unpredictable global payment environments.

Guarantees and Bonds

Guarantees and bonds are important trade finance activities that strengthen trust among stakeholders. They ensure performance, protect contractual obligations, and safeguard investments. For logistics players, these financial instruments enhance credibility and confidence while securing international trade flows across multiple regions.

Structured Trade Financing Programs

Structured financing programs enhance trade finance and treasury operations, allowing companies to scale successfully. These programs combine tailored financial solutions, risk coverage, and liquidity tools, ensuring exporters, importers, and logistics providers have the necessary resources to manage growth while supporting consistent international trade expansion.

Why Trade Finance Matters?

Trade finance and supply chain finance are vital for logistics firms because they stabilise cash flow, lessen risk, and support growth. These advantages enable logistics players to provide better services and remain competitive in international markets.

Cash Flow Stability

By closing timing gaps in payments, trade finance stabilises cash flow for logistics companies. It gives importers deferred payment options and provides exporters with upfront liquidity. This balance fosters financial strength and smooth operations during lengthy international settlement cycles across various trade routes.

Risk Management

Trade finance audit methods ensure transparency while reducing risks linked to credit defaults and fluctuating currencies. Regular audits protect stakeholders by identifying weaknesses in financing processes, minimising losses, and reinforcing trust in logistics companies managing large volumes of international shipments.

Expansion for SMEs

Smaller logistics companies utilize trade finance and lending to grow their operations without straining their cash reserves. Financing options provide them with opportunities to enter larger markets and offer competitive services alongside established global logistics firms.

Operational Resilience

Disruptions pose challenges for logistics firms worldwide. Trade finance use cases demonstrate how predictive analysis and automation enhance resilience by spotting payment risks, optimising funding decisions, and streamlining compliance, ensuring companies continue operations even during unstable market conditions or sudden global crises.

Competitive Terms

Offering competitive terms often strains working capital. Trade finance practices ensure secure transactions while reducing the risks of money laundering or fraud. By protecting financial flows, logistics players can confidently offer flexible terms, winning more contracts without risking their capital.

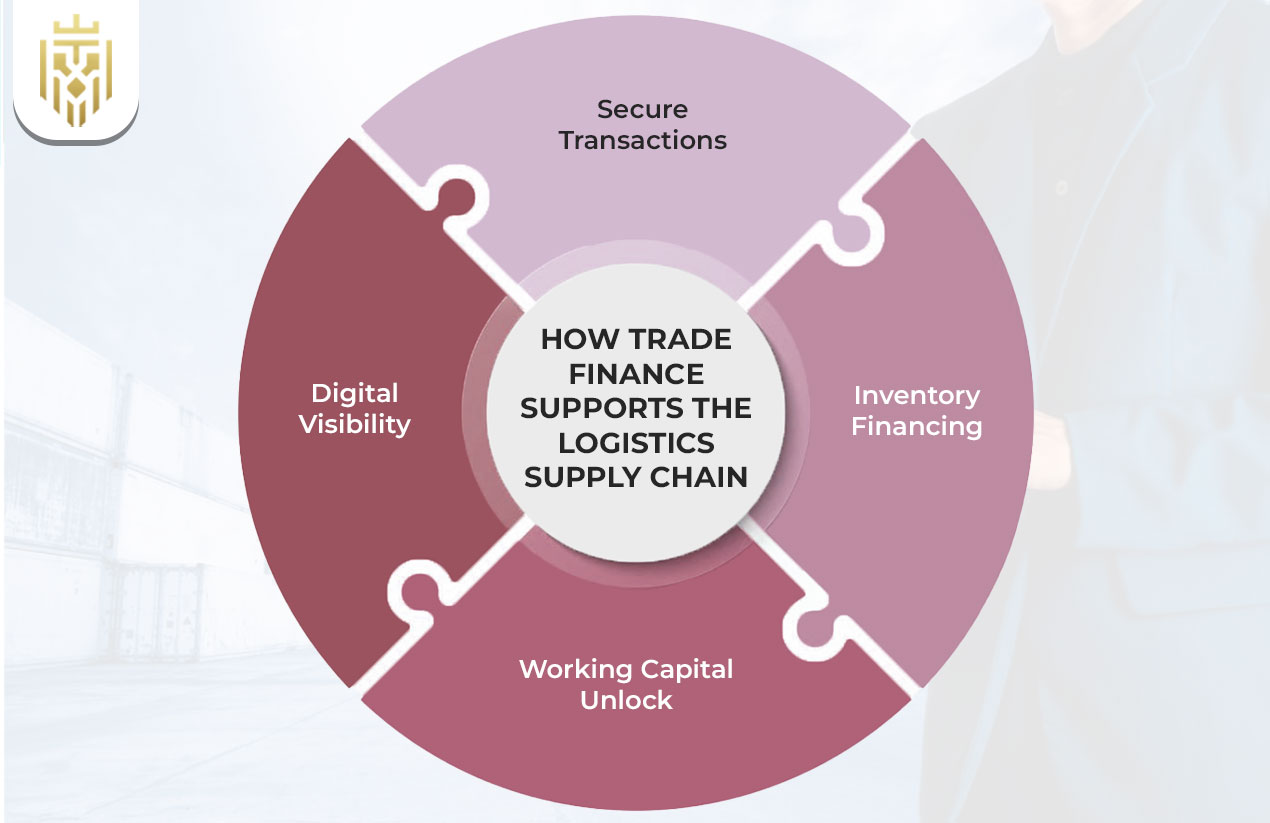

How Trade Finance Supports the Logistics Supply Chain

Through innovative tools, trade finance and treasury methods bolster supply chains by ensuring liquidity, security, and trust. Logistics providers gain resilience, visibility, and financial flexibility, enabling them to maintain smooth operations while navigating unpredictable global trade landscapes.

Secure Transactions

The importance of trade finance is clear in its ability to secure global transactions. Mechanisms such as Letters of Credit, guarantees, and digital platforms protect both importers and exporters. They enhance confidence, lower default risks, and streamline logistics supply chain operations internationally.

Inventory Financing

Through flexible financial solutions, trade finance and supply chain finance allow companies to finance inventory storage and shipping. This ensures logistics providers have enough working capital to keep operations efficient without sacrificing liquidity, maintaining consistent global trade networks.

Working Capital Unlock

By leveraging trade finance account facilities, companies unlock working capital against trade documents like invoices and bills of lading. This allows exporters to access cash more quickly while supporting importers with credit terms, ensuring smooth logistics and uninterrupted global trade.

Digital Visibility

Digitalization is changing international trade finance. New platforms enhance visibility by tracking transactions, verifying documentation, and monitoring compliance in real-time. These tools increase transparency for logistics providers, reducing errors and ensuring efficient financial management within interconnected global supply chains.

FAQs

1. What exactly is trade finance in logistics?

Trade finance in logistics involves financial tools and funding that close payment gaps, manage risks, and ensure smooth cross-border trade by connecting goods movement with secure cash flow.

2. How do instruments like letters of credit or supply chain finance help logistics firms?

Letters of credit guarantee payments, and supply chain finance offers flexible liquidity. Together, they protect exporters, lighten the burden on importers, and help logistics firms maintain stability and credibility in global transactions.

3. Can trade finance truly help SMEs in logistics compete globally?

Trade finance supports small and medium-sized enterprises by providing access to credit, lowering upfront payment pressure, and allowing competitive contract terms. This enables smaller logistics companies to grow confidently in global supply chain markets.

4. How does trade finance reduce operational disruptions during market uncertainties?

Trade finance reduces risks by ensuring timely payments, liquidity, and protection against defaults or delays. These measures give logistics firms resilience, keeping supply chains running during market shocks or economic disruptions.

5. What’s the benefit of digital platforms supporting trade finance for logistics workflows?

Digital trade finance platforms improve transparency, automate compliance, and enhance real-time visibility. They simplify workflows, cut down documentation errors, and help logistics firms conduct faster, safer, and more efficient global trade operations.