What is Average Order Value (AOV)?

This is one of the fundamental AOV eCommerce metrics, and it essentially shows how much money, on average, a customer spends during any transaction with one company. Businesses track the AOV to decide on marketing, pricing, and other considerations based on the moods and buying patterns of typical customers.

When it comes to retail and logistics, and especially in an eCommerce-driven economy such as India, where digital transactions are on the rise, your AOV could well be the dividing factor between a deadlock and scalable growth. It further helps in keeping revenue targets set and tracking their fulfilment.

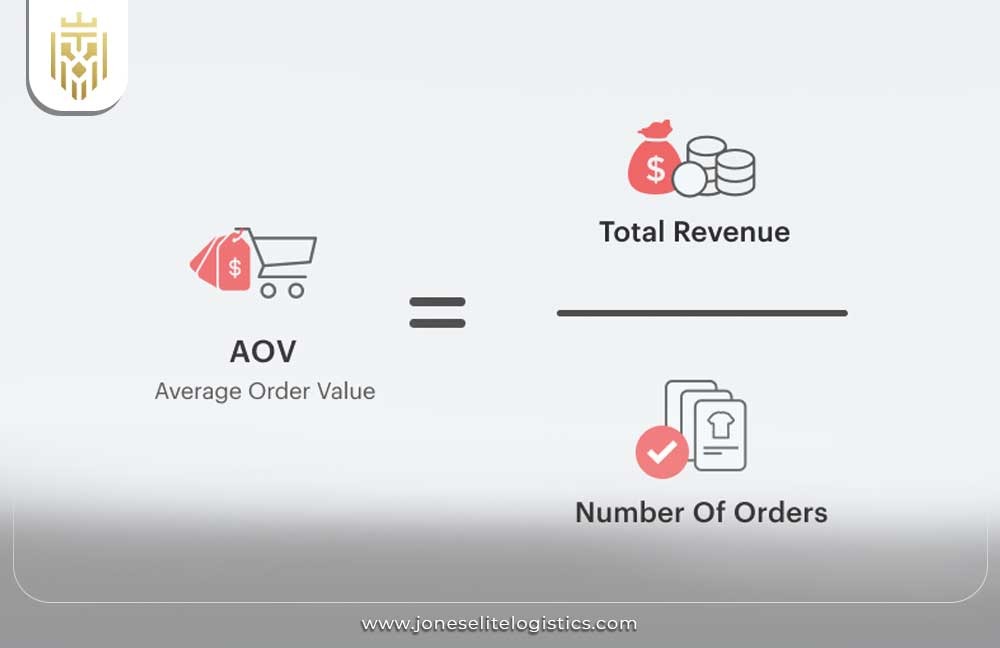

How to Calculate Average Order Value?

The Average Order Value formula is straightforward and used in almost all brick-and-mortar and online commercial setups: AOV = Total Revenue ÷ Number of Orders. Suppose the store made a revenue of ₹500,000 in a month from 2,000 orders; the AOV would then be ₹250. This figure does not allow analysing how many customers go to a store; it rather looks at how much every single customer contributes to your revenue.

Calculating AOV regularly helps businesses make informed decisions regarding product pricing, promotions, and customer engagement efforts. It’s important to separate AOV from other metrics like average revenue per user (ARPU) or customer lifetime value (CLV), as AOV focuses strictly on individual transactions.

What is a good Average Order Value (AOV)?

There really is no “good” number for any given AOV. Mostly this depends on industry standards, pricing systems, and customer expectations. For example, the AOV for an online electronics store is naturally expected to be higher than the AOV for an FMCG platform. An AOV that consistently grows, returns healthy profit margins, and fits its business model makes for the good AOV.

Many companies tend to set benchmark AOVs as part of their financial goals and then judge whether these figures stand for successful upselling or a cross-selling or bundling strategies. Another reason that makes the “good” AOV an expectation is that competitor marketing costs are justified in terms of revenue that a customer converts into sales.

How to Increase Average Order Value?

To boost your revenue without increasing customer count, focusing on increasing the Average Order Value (AOV) is key. Here are several proven strategies businesses can use to encourage customers to spend more per transaction.

Bundling Products

Bundling is selling several related items together with a slight discount or added value. This option helps increase AOV but also increases the customer satisfaction level because the customer believes he is getting more value for his money. For example, a grooming kit could include a trimmer, comb, and scissors, enticing customers to purchase the bundle rather than just one item.

Cross Selling

A cross-selling approach suggests products that complement what customers are buying. Hence, the secondary sale of a mouse or a laptop bag increases the average cart value when a customer adds a laptop to a cart. On the basis of data insights, your cross-sell recommendations should be personalised.

Customer Loyalty Programmes

The concept of loyalty programmes is to encourage repeat purchases with discounts, points, or special perks for consumers and, ideally, to increase order value. If customers see any value in accumulating the points or perks, they tend to choose to increase their spend per transaction. These types of promotions build much stronger, long-term customer relationships.

Strategic Discounts and Promotions

Strategically planned promotions such as “Get ₹100 off on orders above ₹1,000” or “Free delivery for orders above ₹1,500” act as harbingers for customers to increase their basket size. When customers are given limited-time or exclusive promotions, the fear of missing out usually causes them to make faster and bigger purchases.

Highlight Trending Products

Keeping best-sellers or trending products visible to customers leads to some consideration of the possibility to add the product to their cart. Contrast thus heavily increases the perceived value of higher-priced items, accordingly increasing AOV.

Social Proof

Customer reviews, testimonials, and ratings build buyer confidence. Once shoppers see that people have gone through the purchase and enjoyed a similar high-value purchase, they tend to go on with it. Positive feedback alleviates the hesitation to make purchases and supports transactions of higher value.

Why does Average Order Value matter?

AOV plays an important role in registering the revenue strategies. It shows how successful your actions are on pricing, bundling, and upselling. The higher the AOV, the better margins you get, and in return, it reduces the cost of acquiring new customers; it makes the ″most″ out of existing traffic. It’s much more profitable to get a customer that buys for ₹2,000 than one that just spends ₹500.

How Does A/B Testing Improve Average Order Value?

A/B testing, also known as split testing, offers the possibility of trying several alternatives for website elements, marketing messages, or price structures to observe what pulls customers into spending more. For instance, A/B testing can be done on a checkout page: one with a bundled offer and the other without; it would be interesting to see which version leads to a higher AOV.

Testing can also be done on promotional banners, product layouts, upsell messages, and CTA buttons. When small changes like these accumulate over time through data-driven decisions, the purchasing behaviour can be altered significantly. Essentially, if performed well, an A/B test will raise AOV and improve the user experience as well.

Other Important E-commerce Metrics

While AOV is a crucial metric, it’s most effective when evaluated alongside other key eCommerce performance indicators. Here are additional metrics that help provide a fuller picture of customer behaviour and business growth.

Add to Cart

This measures how often visitors put products in their cart and is typically an early stage of purchase intent. A high ratio of add-to-cart with a low AOV can indicate opportunities for upselling or changes in pricing strategies.

Conversion Rate

Conversion rate is a percentage of users who end up buying something. Tracking conversion rate along with AOV helps discern whether the right kind of traffic is attracted and whether the buying process is made smooth enough.

Customer Lifetime Value

The customer lifetime value is the total revenue a business can expect from a customer over the length of the relationship. AOV is a direct contributor to CLV, and the improvement of both makes long-term growth possible.

Customer Acquisition Cost

CAC is the cost of acquiring a new customer. Comparing CAC with AOV ensures that marketing efforts are financially viable. If CAC exceeds AOV significantly, profitability becomes difficult to sustain without increasing repeat purchases.

FAQs

1) What is Average Order Value?

Average Order Value is the average amount of money a customer pays per order. It helps understand customer buying behaviour and helps strategise business moves.

2) How do you calculate average order value?

Total revenue divided by the number of orders placed within a timeframe gives an idea of the money earned per transaction, on average.

3) What is a good average order value?

A good AOV varies by industry. It should reflect your pricing model, target market, and customer expectations while contributing positively to profit margins.

4) Why does Average Order Value matter?

AOV is vital for measuring sales performance, optimising marketing spend, improving customer value, and achieving long-term business growth.

5) What is CLV?

CLV stands for Customer Lifetime Value. It is the total revenue a business expects to earn from a single customer throughout their entire relationship, helping measure long-term business profitability and customer retention impact.

6) What is CAC?

CAC stands for Customer Acquisition Cost. It refers to the total marketing and sales expenses needed to acquire a new customer, and is crucial for understanding the return on investment for customer acquisition strategies.

7) What is FMCG?

FMCG stands for Fast-Moving Consumer Goods. These are low-cost, high-demand products that sell quickly, such as food, beverages, toiletries, and cleaning supplies.

8) What is ARPU?

ARPU stands for Average Revenue Per User. It measures the average income a business earns from each user or customer over a specific period, often used in telecom, SaaS, and subscription-based models.